Filed by the Registrant

Filed by the Registrant Filed by a Party other than the Registrant

Filed by a Party other than the RegistrantUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Filed by the Registrant Filed by the Registrant |  Filed by a Party other than the Registrant Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| CONFIDENTIAL, FOR THE USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to Rule 14a-12 |

ITT Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

| No fee required. | |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) Total fee paid: | |

| Fee paid previously with preliminary materials. |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

2021

Notice of Annual Meeting

ITT Inc.

ITT Inc.

DEAR FELLOW

SHAREHOLDER

RICHARD P. LAVIN

CHAIRMAN OF THE BOARD

April 5, 2021

On behalf of the ITT Inc. Board of Directors, thank you for your continued investment in ITT. The Company delivered another strong performance in 2020 despite the challenges posed by the COVID-19 global pandemic. ITT made continued progress on enhancing operational excellence, including safety, developing innovative new products that are winning in the marketplace and investing in its business and people to deliver long-term value for our shareholders. We invite you to join us at our 2021 Annual Meeting on May 19, 2021 at 9:00 a.m. Eastern Time to be held virtually via a live webcast at www.virtualshareholdermeeting.com/ITT2021. Details regarding how to attend the virtual meeting and the business to be conducted are provided in the accompanying Notice of Annual Meeting and Proxy Statement.

BOARD COMPOSITION AND REFRESHMENT

I had the honor of assuming the role of Chairman of the Board of Directors of ITT Inc.,in May 2020 following the retirement of Frank MacInnis, who served as ITT’s independent chair since 2011. We also announced the retirement of Christina Gold at the end of May 2020. Christina served as a Director for over 23 years, serving on the Audit and Compensation and Personnel Committees. Both Frank and Christina were part of the original ITT Board prior to the spin-off of our defense and water businesses in 2011, and their retirements were part of a thoughtfully planned transition that occurred over the past three years. I cordially invitewould like to thank each of them for their contributions to ITT.

As Chair, I have focused on guiding ITT’s strategies for growth, profitability and capital deployment, and overseeing several new leadership appointments. As in the past, we remain thoughtful about Board composition and effectiveness during our formal annual Board and committee evaluation processes as well as through our director nominations process.

SUCCESSFUL CFO TRANSITION

This past year, we completed a successful CFO transition following the resignation of Thomas Scalera. Emmanuel Caprais was named senior vice president and chief financial officer of ITT in October 2020. Emmanuel joined ITT in 2012 as segment CFO for Motion Technologies, eventually assuming a similar role for the Industrial Process segment in 2017. He also led the Financial Planning & Analysis (FP&A) and Investor Relations functions for ITT and in addition in 2020 was appointed Group CFO. Emmanuel worked closely with Tom and CEO Luca Savi throughout 2020 to ensure a smooth transition.

SHAREHOLDER ENGAGEMENT

Shareholder engagement remains a key priority for the Board. The valuable feedback and perspectives received through discussions with our shareholders help to inform ongoing boardroom discussions. We continued our annual outreach and engagement efforts in 2020, engaging with shareholders collectively representing approximately 47% of our outstanding shares. These discussions centered on our responses to the COVID-19 global pandemic, Board refreshment and diversity, corporate governance, initiatives taken to protect our environment, executive compensation practices and leadership transitions. The company’s shareholders also acknowledged our enhanced sustainability reporting following ITT’s first-ever Sustainability Report published in 2019, which was followed by a 2020 supplement showing our continued progress. The Board recognizes the importance of Environmental, Social and Governance matters and will continue to make this a priority in 2021.

Again, I thank you for your continued support and confidence in ITT. I am honored to attend our 2017serve on this Board and look forward to hearing from ITT’s shareholders in 2021. We hope you can join us at the Annual Meeting of Shareholders, which will be held on Wednesday, May 10, 2017 at Meeting.

Sincerely,

RICHARD P. LAVIN

NOTICE OF 2021 ANNUAL MEETING OF SHAREHOLDERS

MEETING INFORMATION

WEDNESDAY, MAY 19, 2021

9:00 a.m. Eastern Time

Virtually, via live webcast at ITT Inc. Headquarters, 1133 Westchester Avenue, White Plains, NY 10604.

ITEMS OF 2017 ANNUAL MEETING OF SHAREHOLDERS

| To elect the | ||

| To ratify the appointment of Deloitte & Touche LLP as the | ||

| To conduct an advisory vote on the compensation of the | ||

| To | ||

| To transact such other business as may properly come before the Annual Meeting or any | ||

WHO CAN VOTE, RECORD DATE

Holders of record of ITT Inc. common stock at the close of business on March 22, 2021 are entitled to vote at the Annual Meeting and any adjournment or postponement thereof.

MAILING OR AVAILABILITY DATE

Beginning on or about April 5, 2021, this Notice of 2021 Annual Meeting of Shareholders and the attached Proxy Statement are being mailed or made available, as the case may be, to shareholders of record on March 22, 2021.

ABOUT PROXY VOTING

It is important that your shares be represented and voted at the Annual Meeting. If you are a registered shareholder, you may vote online at www.proxyvote.com, by telephone or by mailing a proxy card. You may also vote online during the virtual Annual Meeting. If you hold shares through a bank, broker or other institution, you may vote your shares by any method specified on the voting instruction form that they provide. See details under “How do I vote?” under “Information about Proxy Statement and Voting.” We encourage you to vote your shares as soon as possible.

By order of the Board of Directors,

MARY BETH GUSTAFSSON

Senior Vice President, General

Counsel, Corporate Secretary and Chief Compliance Officer

April 5, 2021

| REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: | |||

|  |  |  |

ONLINE Visit the website on | BY MAIL Sign, date and return your proxy | BY PHONE Call the telephone number | DURING THE ANNUAL MEETING Attend the Virtual Annual Meeting and Vote |

| Please refer to the enclosed proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you. | |||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR ITT Inc.’s Annual Meeting of Shareholders to be held on Wednesday, May 19, 2021, at 9:00 a.m. Eastern Time | |||

| ITT INC. | 2021 PROXY STATEMENT | 5 |

| ITT INC. | 2021 PROXY STATEMENT | 6 |

This summary highlights selected information in this Proxy Statement. Please review the entire document before voting. Your vote is important. You are eligible to vote if you were a shareholder of record at the close of business on March Proxy Statement HighlightsPROXY

Date TimeLocationAdmission InformationMay 19, 2021May 10, 2017Time9:00 a.m. ITT Inc. Headquarters1133 Westchester AvenueWhite Plains, NY 10604Voting Items Eastern Time Location Voting ItemBoard Voting RecommendationFurther Information(page)1. To elect the 10 nominees named in the Proxy Statement to ITT's Board of DirectorsFOR each nominee2. To ratify the appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm for 2017FOR3. To conduct an advisory vote on the compensation of the Company's named executive officersFOR4. To conduct an advisory vote to determine the frequency of future shareholder votes on the compensation of the Company's named executive officersFORone yearVirtually, via live webcast at www.virtualshareholdermeeting.com/ITT2021 How to VoteVoting Item Board Voting

RecommendationFurther

Information (page)1. To elect the 11 nominees named in the Proxy Statement to ITT’s Board of Directors FOR

each nominee26 2. To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2021 FOR 33 3. To conduct an advisory vote on the compensation of the Company’s named executive officers FOR 37 4. To consider a shareholder proposal regarding special meetings of shareholders AGAINST 71 13, 2017.22, 2021. Even if you plan to attend the meeting, please vote as soon as possible using one of the following methods. In all cases, you should have your proxy card in hand.

| YOUR VOTE IS IMPORTANT: | ||||||

|  |  |  | |||

| ONLINE Visit the website on your proxy card | BY MAIL Sign, date and return your proxy card in the enclosed envelope | BY PHONE Call the telephone number on your proxy card | DURING THE ANNUAL MEETING Attend the Virtual Annual Meeting and Vote by Internet. See page 75 for instructions on how to attend |

| ITT INC. | 2021 PROXY STATEMENT | 7 |

(Amounts reported in this section, except per share amounts, are stated in millions unless otherwise specified.)

During 2020, we achieved strong results that reflect continued operational excellence and share gains in key global markets. Our results are a reflection of our hard work and focus on creating value for our customers, while also implementing productivity improvements and making strategic investments to drive profitable growth. The following table provides a summary of our key performance indicators for 2020 with growth comparisons to 2019.

SUMMARY OF KEY PERFORMANCE INDICATORS FOR 2020

| Revenue | Segment Operating Income | Segment Operating Margin | EPS | Operating Cash Flow | ||||

| $2,478 (13%) | $319 (26%) | |||||||

(230 bps) | (79%) | 22% | ||||||

| Organic Revenue | Adjusted Segment Operating Income | Adjusted Segment Operating Margin | Adjusted EPS | Free Cash Flow | ||||

| $2,455 (14%) | $376 (18%) | 15.2% (80 bps) | $3.20 (16%) | $372 40% |

Organic revenue, adjusted segment operating income, adjusted segment operating margin, adjusted EPS and free cash flow are financial measures not prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), which are referred to as non-GAAP financial measures. Please refer to the section titled “Key Performance Indicators and Non-GAAP Financial Measures” in our 2020 Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on February 19, 2021 for the definition of these non-GAAP financial measures, the reasons why we use these measures and for reconciliations to the most directly comparable measures calculated in accordance with GAAP.

Our 2020 results include:

| ■ | Revenue of $2,477.8 decreased $368.6, including $24.4 from our 2019 acquisitions and unfavorable foreign exchange of $1.3. Organic revenue decreased 13.8%, mainly as a result of the global impact of COVID-19 which drove declines in transportation of 16%, industrial of 7%, and oil and gas of 23%. Sequentially, revenue increased in each of the last two quarters of 2020, from $514.7 in the second quarter to $591.2 in the third quarter and $708.6 in the fourth quarter. |

| ■ | Segment operating income of $318.6 declined $113.7, which included higher restructuring and asset impairment costs of $28.1 and $15.3, respectively. Adjusted segment operating income declined $80.3 due to reduced volume from weaker demand and disruption caused by COVID-19, partially offset by savings from restructuring, productivity and cost actions. Sequentially, segment operating income increased in each of the last two quarters of 2020, from $37.3 in the second quarter to $83.9 in the third quarter and $119.5 in the fourth quarter. |

| ■ | Income from continuing operations decreased $254.9, which included increased pension costs of $108.2, net of tax, from the termination of our U.S. qualified pension plan, a decline in segment operating income, and higher asbestos costs of $64.4, net of tax, primarily to extend the period over which we estimate our net liability through 2052 (i.e., “full horizon”), partially offset by a reduction in corporate costs. As a result, earnings per diluted share decreased from $3.65 to $0.78. Adjusted earnings per share was $3.20, reflecting a decrease of $0.61 from the prior year. |

| ■ | Operating cash flow of $435.9 increased $78.2 or 21.9%, primarily due to higher collections from customers, improved inventory management and cost containment measures. Operating cash flow less capital expenditures was $372, an increase of $106 or 40%. |

| ITT INC. | 2021 PROXY STATEMENT | 8 |

SNAPSHOT OF 2021 DIRECTOR NOMINEES

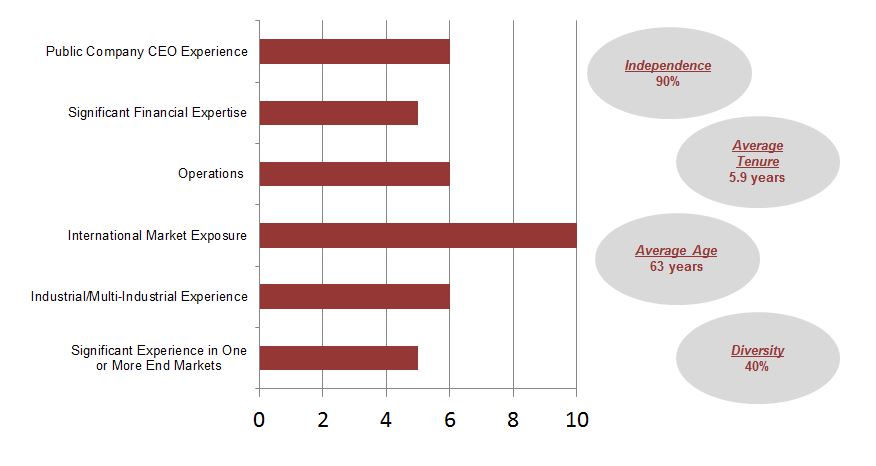

As a whole, our director nominees possess a variety of important qualifications, skills and attributes, including those set forth in the chart below:

| DIRECTOR SNAPSHOT | ||||||||||||||

| Board Committees | ||||||||||||||

| Name | Age | Director Since | Other Public Company Boards | Position | Audit | Compensation and Human Capital | Nominating and Governance | |||||||

| Orlando D. Ashford | 52 | 2011 | 2 | Executive Chairman of Azamara |  |  | ||||||||

| Geraud Darnis | 61 | 2015 | 0 | Former President & CEO of UTC Building & Industrial Systems |  |  | ||||||||

| Donald DeFosset, Jr. | 72 | 2011 | 3 | Former Chairman, President & CEO of Walter Industries, Inc. |  |  | ||||||||

| Nicholas C. Fanandakis | 64 | 2016 | 2 | Former Executive Vice President of DowDuPont |  |  | ||||||||

| Richard P. Lavin non-executive Chairman | 69 | 2013 | 1 | Former President & CEO of Commercial Vehicle Group, Inc. | ||||||||||

| Mario Longhi | 66 | 2017 | 2 | Former President & CEO of United States Steel Corporation |  |  | ||||||||

| Rebecca A. McDonald | 68 | 2013 | 0 | Former CEO of Laurus Energy, Inc. |  |  | ||||||||

| Timothy H. Powers | 72 | 2015 | 0 | Former Chairman, President & CEO of Hubbell Incorporated |  |  | ||||||||

| Luca Savi | 55 | 2019 | 0 | CEO & President of ITT Inc. | ||||||||||

| Cheryl L. Shavers | 67 | 2018 | 1 | Chairman & CEO of Global Smarts, Inc. |  |  | ||||||||

| Sabrina Soussan | 51 | 2018 | 1 | CEO of dormakaba Holding AG |  |  | ||||||||

| Chair |

| * | Is a citizen of a non-U.S. country (in some cases, in addition to the U.S.) |

| ITT INC. | 2021 PROXY STATEMENT | 9 |

CORPORATE GOVERNANCE HIGHLIGHTS

We are committed to strong governance practices that protect the long-term interests of our shareholders and establish strong Board and management accountability. The “Corporate Governance and Related Matters” section beginning on page 12 describes our governance framework. We have adopted key corporate governance best practices, including:

| WHAT WE DO | ||||

| Independent Chair |  | Annual Board and committee evaluation and self- assessments | |

| Highly independent and diverse Board |  | Active Board refreshment | |

| Annual election of directors |  | Director skill sets aligned with corporate strategy | |

| Majority voting for uncontested director elections |  | Formal limit on outside directorships | |

| Regular executive sessions of the Board and its committees |  | Meaningful stock ownership guidelines for directors | |

| Proxy access right |  | Formal director orientation and continuing education program | |

| Shareholder right to call special meetings |  | Proactive engagement with shareholders | |

| A policy prohibiting hedging and pledging of the Company’s securities | |||

SHAREHOLDER ENGAGEMENT AND RESPONSIVENESS

Since formalizing our shareholder engagement approach in 2017, we have reached out to shareholders representing over 50% of ITT’s outstanding shares annually to discuss governance, compensation, sustainability and other matters of shareholder concern. In 2020 we built on this success and continued our robust annual shareholder engagement process, contacting shareholders representing 69% of ITT’s outstanding shares and engaging with shareholders representing over 47% of outstanding shares. During our 2020 shareholder engagement process, we reached the highest percentage of shares owned by our investors since adopting our current approach to shareholder engagement in 2017. The feedback we received was shared with the Board and members of senior management. Key themes from these conversations included our proactive actions to address the COVID-19 pandemic, corporate governance, executive compensation, and sustainability initiatives.

These conversations continue to inform our Board’s actions, including our approach to Board refreshment and diversity, our executive compensation practices, and our reporting efforts on sustainability topics. For example, the Sustainability Report that ITT published in February 2019, and the 2020 supplemental report showing our three-year progress on environmental and social metrics, were shaped by our discussions with investors.

We encourage our registered shareholders to use the space provided on the proxy card to let us know your thoughts about ITT or to bring a particular matter to our attention. If you hold shares through an intermediary or received the proxy materials electronically, please feel free to write directly to us.

EXECUTIVE COMPENSATION HIGHLIGHTS

ITT and its employees, customers and suppliers were significantly impacted by the global COVID-19 pandemic. ITT’s

Board of Directors and management took quick and decisive action to address the uncertainty created by the pandemic and approved temporary changes to some compensation programs. The objective of these changes was to preserve cash and liquidity during a time of great uncertainty regarding the severity and length of the pandemic’s impact on business conditions.

| ■ | The total annual compensation of non-employee directors elected at the Company’s 2020 annual meeting in May 2020 was reduced by 20% effective from the annual meeting on |

| ITT INC. | 2021 PROXY STATEMENT | 10 |

May 15, 2020 through December 31, 2020 and then reinstated on a pro-rata basis for the balance of their term effective January 1, 2021.

| ■ | The annual salary of the CEO was reduced by 20% effective from April 1, 2020 through December 31, 2020 and then reinstated effective January 1, 2021. |

| ■ | The annual salary rates of the other Executive Officers were reduced by 20% effective from April 1, 2020 through September 30, 2020 and then reinstated effective October 1, 2020. |

The Compensation and Human Capital Committee continues to firmly believe in pay-for-performance and has structured the executive compensation program to align our executives’ interests with the long-term interests of our shareholders. Although 2020 was a challenging year, the Compensation and Human Capital Committee did not make any adjustments to the performance targets for the unvested performance stock unit awards (“PSUs”) and did not grant any special stock awards to executive officers.

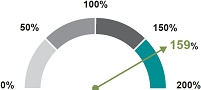

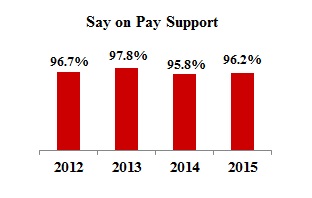

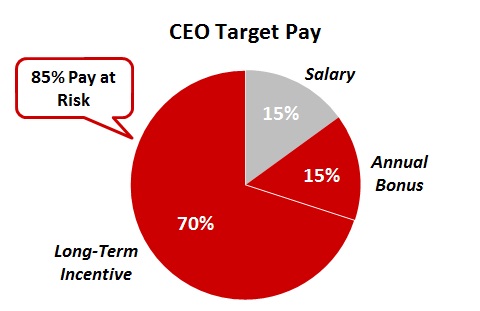

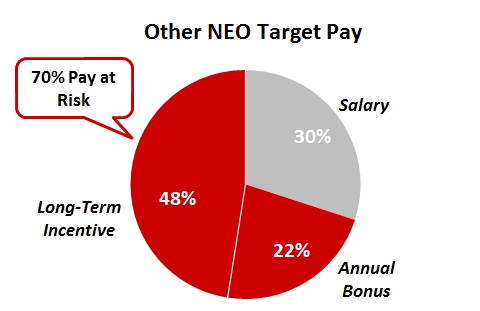

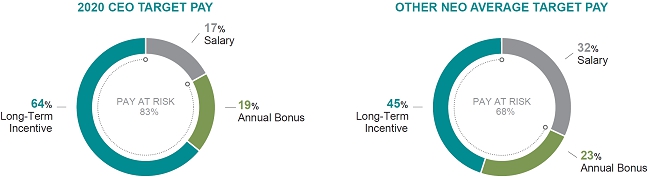

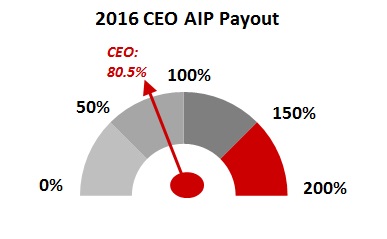

Our CEO and other named executive officers (the “Named Executive Officers” or “NEOs”) have a significant amount of their target pay tied to our Annual Incentive Plan (“AIP”) and long-term incentives (“LTI”), which is at-risk pay and dependent on ITT’s financial performance and stock price. Despite the challenging business conditions that resulted from the pandemic, ITT generated record free cash flow and achieved adjusted operating margin that was close to the target that was approved in February 2020, before the pandemic was declared and therefore before the extent of the financial impact of COVID-19 was known. These results drove a 2020 CEO AIP payout that was 86% of target, which we consider an exceptional result considering the downturn in some of our key end markets such as auto, aerospace, and oil & gas. The 3-year performance of ITT’s relative total shareholder return (“TSR”) and Return on Invested Capital (“ROIC”) resulted in a 2018 PSU payout above target at 159%.

| 2020 CEO AIP PAYOUT | 2018 PSU PAYOUT |

|  |

At ITT we believe that improving our sustainability efforts creates value for our customers, employees, communities and shareholders. It helps us align to the values and emerging expectations of today’s world. In 2019, ITT issued a sustainability report which incorporated Sustainability Accounting Standards Board (“SASB”) metrics relevant to ITT, as requested by many of our shareholders in our engagement discussions. In 2020, ITT issued an annual supplemental report which included our three-year progress on key environmental, social and governance (“ESG”) metrics.

| ITT INC. | 2021 PROXY STATEMENT |

We strive to maintain the highest standards of corporate governance and ethical conduct. Maintaining full compliance with the laws, rules and regulations that govern our business, and reporting results with accuracy and transparency, are critical to those efforts. We monitor developments in the area of corporate governance, consider the feedback of our shareholders, and reviewsreview our processes and procedures in light of these developments.this input. We also review federal and state laws affecting corporate governance, as well as rules and requirements of the New York Stock Exchange (the "NYSE"“NYSE”). We implement other corporate governance practices that we believe are in the best interests of the Company and its shareholders.

We also understand that corporate governance practices evolve over time, and we seek to maintain practices whichthat provide the right framework for our Company to operate within, whichoperations at that time, that are of value to our shareholders and whichthat positively aid in the governance of the Company. Following are some of our key corporate governance practices:

The following sections provide an overview of ITT'sITT’s corporate governance structure and processes, including the independence criteria and other criteria we use in selecting director nominees;nominees, our leadership structure;structure, and certain responsibilities and activities of the Board of Directors and its committees.

ITT’s key governance documents, including the most current versions of our Corporate Governance Principles (the "Principles"“Principles”), and the charters for the Audit, Compensation and PersonnelHuman Capital and Nominating and Governance Committees, are available on our website at

The Board of Directors has adopted the Principles, which govern the operationoperations of the Board of Directors and its committees and guide the Board of Directors and ITT'sITT’s leadership team in the execution of their responsibilities. The Nominating and Governance Committee is responsible for overseeing the PrinciplesPrinciples. The Nominating and Governance Committee reviews themthe Principles at least annually and makes recommendations to the Board of Directors for updates in response to changing regulatory requirements, issues raised by shareholders or other stakeholders, changing regulatory requirements or otherwise as circumstances warrant. The Board may amend, waive, suspend or repeal any of the Principles at any time, with or without public notice, as it determines necessary or appropriate in the exercise of the Board'sBoard’s judgment or fiduciary duties. As noted above, we have posted the Principles on our website at:

| ■ | no director may stand for re-election after he or she has reached the age of 75; |

| ■ | directors must be able to devote the requisite time for preparation and attendance at regularly scheduled Board and Committee meetings, as well as be able to participate in other matters necessary for good corporate governance; |

| ■ | non-employee directors are limited to service on four public company boards (including the ITT Board). If the director serves as an active CEO of a public company, the director is limited to service on two public company boards (including the ITT board) in addition to service on his or her own board; |

| ■ | the CEO is limited to service on one public company board (in addition to service on the ITT Board). Currently, the CEO serves only on the ITT Board; |

| ■ | the CEO reports at least annually to the Board on succession planning and management development; |

| ■ | the Board evaluates the performance of the CEO and other senior management personnel at least annually; and |

| ■ | the Board maintains a process whereby the Board and its committees are subject to annual evaluation and self-assessment. |

ITT INC. | 2021 PROXY STATEMENT12

OUR BOARD LEADERSHIP STRUCTURE

Richard P. Lavin is Chairman of the Board of Directors and Luca Savi is our Chief Executive Officer and other senior management personnel at least annually; and

Although the Board may determine to combine the roles of ChairmanChair and Chief Executive Officer in the future, since 2011 the Board has determined that having separate individuals holdholding the ChairmanChair and Chief Executive Officer positions is the right leadership structure for the Board.Company. This structure allows our Chief Executive Officer to focus on the operations of our business while the independent ChairmanChair focuses on leading the Board in its responsibilities. The Board most recently considered the appropriate leadership structure for the Board as part of the recently completed CEO transition and, taking into account feedback from our shareholders, confirmed that this separation continues to be in the best interests of ITT’s shareholders at this time as well as for the foreseeable future.

THE BOARD’S ROLE IN LEADERSHIP SUCCESSION PLANNING

The Board is actively engaged in our talent management program. The Compensation and Human Capital Committee oversees the process for succession planning for the CEO and other senior executives and updates the full Board in its executive sessions. The Board holds a formal succession planning and talent review session each summer. These sessions include the identification and development of internal candidates and assessment of key capabilities, desired leadership skills, and the ability to influence our business and strategic direction consistent with our core values. As part of the succession planning process, the CEO, working with the Board, also reviews and maintains an emergency succession plan for the position of CEO.

Directors interact with ITT leaders through Board presentations and discussions, as well as through informal events and interactions throughout the year such as lunch, dinner, and small group and planned one-on-one sessions.

DIRECTORS’ QUALIFICATION AND SELECTION PROCESS

BOARD MEMBERSHIP CRITERIA

The Nominating and Governance Committee regularly considers and reviews with the Board the appropriate skills and characteristics for Board members in fulfilling its responsibility to identify and recommend qualified candidates for membership on the Board.

The Corporate Governance Principles state that as part of the membership criteria for new Board members, individuals who are nominated are expected to have significant accomplishments and recognized business stature and possess attributes and experiences such as diversity, management skills and business, technological and international experience. The Nominating and Governance Committee’s top priority is therefore ensuring that the Board is composed of directors who bring diverse viewpoints and perspectives, exhibit a variety of skills, professional experience and backgrounds, and effectively represent the long-term interests of shareholders.

Additional criteria for identifying and evaluating candidates for the Board include:

| ■ | personal qualities and characteristics, accomplishments and reputation in the business community; |

| ■ | current knowledge and contacts in the Company’s business communities and industries; |

| ■ | the fit of the individual’s skills and personality with those of other directors in building a Board that is effective, collegial and responsive; |

ITT INC. | 2021 PROXY STATEMENT13

| ■ | ability and willingness to commit adequate time to Board and committee matters; |

| ■ | diversity of viewpoints, background, experience and other demographics; |

| ■ | independence (including independence from the interests of a particular group of shareholders); |

| ■ | absence of potential conflicts with our interests; and |

| ■ | such other criteria as the Board may from time to time determine relevant. |

DIRECTOR SKILLS

Our director nominees possess relevant experience, skills and qualifications which contribute to a well-functioning Board that effectively oversees the Company’s strategy and management. All of our director nominees bring to the Board a wealth of executive leadership experience derived from their diverse professional backgrounds and areas of expertise. As a group, they have global industrial and financial expertise, public company board experience and sound business acumen.

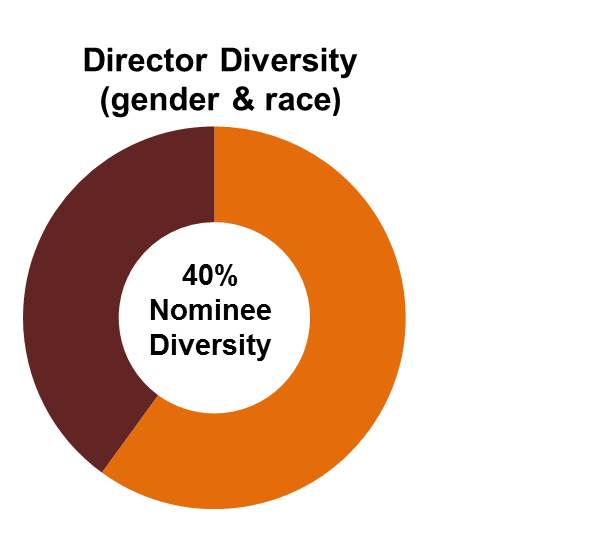

BOARD DIVERSITY

The Board actively seeks to consider diverse candidates for membership on the Board when it has a vacancy to fill and includes diversity as a specific factor when conducting any search for candidates. In identifying and evaluating candidates for the Board, the Nominating and Governance Committee considers the diversity of the Board, including diversity of skills, experience and backgrounds, as well as ethnic and gender diversity. We believe that our Board nominees appropriately reflect a diversity of skills, of professional, gender, ethnic and personal backgrounds, and of experience.

| 27% | ||

| female | |||

| 27% | ||

| racially/ethnically diverse | |||

| 36% | ||

| citizens of non-U.S. countries* | |||

| * | In some cases in addition to the U.S. | ||

BOARD TENURE

The Board also strives to maintain an appropriate balance of tenure and turnover among directors. The Board believes that there are significant benefits from the valuable experience and familiarity with the Company and its people and processes that longer-tenured directors bring, as well as significant benefits from the fresh perspective and ideas brought by new directors. We believe that our Board strikes the right balance of longer serving and newer directors.

PROCESS FOR IDENTIFYING AND SELECTING NEW BOARD MEMBERS

The Nominating and Governance Committee identifies director candidates through a variety of sources including an independent search firm, personal references, and business contacts.

Shareholders who wish to recommend candidates may contact the Nominating and Governance Committee in the manner described in “Communication with the Board of Directors.” Shareholder nominations must be made according to the procedures required by our Amended and Restated By-laws (the “By-laws”) and described in this Proxy Statement under the heading “Information about the Proxy Statement & Voting.” Shareholder recommended candidates and shareholder nominees whose nominations comply with these procedures and who meet the criteria referred to above will be evaluated by the Nominating and Governance Committee in the same manner as other nominees.

ITT INC. | 2021 PROXY STATEMENT14

A key component to the nomination (and re-nomination) process is the Nominating and Governance Committee’s consideration of the results of the Board’s evaluation process. The results generated from this evaluation process include nominee attributes and experiences that will individually and collectively complement the existing Board, taking into account the Board’s needs for expertise and recognizing that the Company’s businesses and operations are diverse and global in nature.

Prior to recommending nominees for election as directors, the Nominating and Governance Committee, and then the full Board of Directors, engages in a deliberative process and considers the following to ensure that the nominee will contribute to an effective Board of Directors:

| ■ | the nominee’s fit with the membership criteria discussed above; |

| ■ | the nominee’s skills and attributes and overall complement to the skills matrix discussed above; and |

| ■ | the diversity that the nominee will add to the Board. |

Biographical information for each candidate for election as a director is evaluated and candidates for election participate in interviews with existing Board members and management. Each candidate is subject to thorough background checks and nominees must meet the requirements of the Company’s By-laws and the Corporate Governance Principles.

BOARD AND COMMITTEE EVALUATION PROCESS

We recognize the critical role that Board and committee evaluations play in ensuring the effective functioning of our Board. Our Board annually evaluates the performance of the Board and its committees. As part of the Board’s self-assessment process, directors complete questionnaires that consider various topics related to Board composition, structure, effectiveness, and responsibilities, as well as the overall mix of director skills, experience, and backgrounds. As set forth in its charter, the Nominating and Governance Committee oversees the Board and committee evaluation process. Annually, the Nominating and Governance Committee reviews the questionnaires and the process and considers whether changes are recommended.

TOPICS CONSIDERED DURING THE BOARD AND COMMITTEE SELF-ASSESSMENTS INCLUDE:

| Board and Committee Operations | Board Performance | Committee Performance |

| ■ Board and committee membership, including director skills, background, expertise and diversity | ■ Key areas of focus for the Board | ■ Performance of committee duties under committee charters |

| ■ Committee structure and process, including keeping the full Board abreast of committee matters | ■ Oversight of the Company’s strategy | ■ Effectiveness of management support for committees |

| ■ Access to management, experts and internal and external resources | ■ Effectiveness of risk oversight | ■ Identification of topics that should receive more attention and discussion, particularly emerging risk areas |

| ■ Materials and information, including the quality and quantity of information received | ■ Performance of Board Chair | ■ Performance of committee chairs |

| ■ Conduct of meetings, including encouragement of and time allocated for candid dialogue |

The Company’s Corporate Secretary aggregates and summarizes all of the directors’ responses to the questionnaires, highlighting comments and year-over-year trends. Responses are not attributed to specific Board or committee members to promote candor. These summaries are shared with the Board and committee members to inform their review and discussion. The Chair of the Nominating and Governance Committee, with support from the Corporate Secretary, leads a discussion of the Board and committee results at the Nominating and Governance Committee meeting as well as with the full Board. Each committee chair, with support from the Corporate Secretary, leads a discussion at their committee meeting of their individual assessments. As a result of these discussions, an action plan is created and practices are updated based on the self-assessment observations and suggestions. As an outcome of these discussions, directors share relevant feedback with management and suggest changes or areas of improvement or focus.

In addition to the in-person review of the results of the Board and committee self-assessments, at least once per year our independent Chair has individual one-on-one discussions with each director to elicit any further information about their views on

ITT INC. | 2021 PROXY STATEMENT15

| Back to Contents |

the functioning of the Board and its committees. Feedback from those discussions is also incorporated into the overall action plan. Examples of changes made in response to the self-assessment process over the last several years include:

| ■ | prioritizing diversity in the next director search; |

| ■ | increased Board exposure both formally and informally to key executives; |

| ■ | additional reserved time for “Board only” discussions to continue to foster openness and cohesiveness among the Board; and |

| ■ | a coordinated director education schedule to provide additional education on relevant topics as part of regularly scheduled meetings. |

The Board of Directors has considered whether to engage an independent third party to conduct or facilitate the Board self-assessments and has to-date concluded that an independent review is not necessary. The Board has agreed that it will consider this option as needed.

The results of the self-assessment process in 2020 confirmed the Board’s belief that the Board and its committees are currently operating effectively.

DIRECTOR ORIENTATION AND CONTINUING EDUCATION

As part of ITT’s director orientation program, new directors participate in one-on-one introductory meetings with members of ITT’s leadership team and other functional leaders. This director orientation familiarizes the directors with our business and strategic plans, significant financial, accounting and risk management issues, human resources matters, our compliance programs and other controls, policies, and procedures. The orientation also addresses Board procedures, our Principles and our Board committee charters. Finally, it provides directors with the opportunity to meet with our officers and other key members of senior management.

The Company endeavors to provide ongoing director education throughout the year. Our annual strategy session, where senior management presents the strategic plans for each of the businesses and the Company as a whole, is one component of that ongoing education. We valueaim to periodically hold the annual strategy session at an ITT facility in order to increase the Board’s understanding of the Company’s people, operations, product lines, and overall business. Our senior management also presents topics throughout the year to the Board in order to increase their understanding of the Company’s business operations, strategies, risks and opportunities.

Directors may enroll in external continuing education programs at ITT’s expense on topics associated with a director’s service on a public company board in order to provide a forum for them to maintain their insight into leading governance practices, exchange ideas with peers, and keep current their skills and understanding of their duties as directors.

Our Board values the views of our shareholders, and other stakeholders, and the input thatfeedback we receive from themshareholders is a key input to our corporate governance, executive compensation, and sustainability practices. Our

ENGAGEMENT PROGRAM

Since formalizing our shareholder engagement program is management ledapproach in 2017, we have reached out annually to shareholders owning over 50% of ITT’s outstanding shares to discuss governance, compensation, sustainability and overseen by the Board. Our discussionsother matters of shareholder concern. In 2020, we expanded our outreach to cover shareholders representing 69% of ITT’s outstanding shares, and engaged with shareholders can cover a wide rangerepresenting over 47% of topics, including financialoutstanding shares, which is the highest percentage of share ownership engaged since we adopted our current approach to shareholder engagement in 2017. The feedback we received was shared with the Board and operating performance, strategy, capital allocation, corporate governance, executive compensation, social, safety, environmental and other issues.members of senior management. We believe that it is important for the Company to have a direct line of communication with shareholders so that the Board and management to understand shareholder's views and concerns so that we are better able to address issues that matterassess our policies and practices continually.

ITT INC. | 2021 PROXY STATEMENT16

FALL 2020 ENGAGEMENT FEEDBACK

An overview of the specific areas of focus for our shareholders during these meetings is provided in the table below:

Shareholder Engagement Outreach Efforts

| Percent of Shares Outstanding Contacted: | Percent of Shares Outstanding Engaged: | |

| 69% | 47% | |

| Specific Areas of Focus and Feedback | ||

| Corporate Governance | Executive Compensation | Sustainability | ||

| Board Diversity & Refreshment | Compensation Program | Sustainability Reporting | ||

| ■ Discussed how the Board’s evaluation process supports thoughtful refreshment | ■ Shareholders understood the relevance of our compensation program metrics to our business strategy and acknowledged our link between pay and performance | ■ Shareholders appreciated ITT’s recent reporting efforts, including SASB aligned metrics and 2020 supplement to our Sustainability Report | ||

| ■ Shareholders recognized ITT’s commitment to Board diversity, including gender, race/ethnicity, age, geography, and business experience | ■ Shareholders supported the metrics and weighting of our incentive plans, and the decision not to adjust plan designs due to the financial impact of the pandemic. Shareholders stressed that any discretion applied for AIP payouts should include robust disclosure | ■ Shareholders encouraged ITT to consider setting specific sustainability- related goals, including carbon emissions | ||

| ■ Shareholders appreciated ITT’s smooth leadership succession process, including the CEO transition in 2019 and the CFO, Value Center Presidents and independent Chair transitions in 2020 | ■ Shareholders understood the actions taken by the Board of Directors in light of the pandemic to approve temporary compensation reductions for Directors, the CEO, and other Executive Officers | ■ Discussed investors’ views on various data sources and reporting standards | ||

| Governance | Employees | Board Oversight of Sustainability | ||

| ■ Shareholders appreciated ITT’s robust corporate governance profile and practices, including our long-standing independent Chair role | ■ Shareholders were interested to understand the actions taken to keep employees safe and productive during the pandemic | ■ Discussed the Nominating & Governance Committee’s oversight of ESG risks impacting ITT | ||

| ■ Shareholders discussed and generally supported ITT’s current threshold required to call a special meeting | ■ Shareholders appreciated the diversity metrics published in the 2020 supplement to our Sustainability Report, and encouraged disclosure of diversity targets | ■ Discussed the Compensation & Human Capital Committee’s focus on cultivating an innovative, diverse and inclusive workplace that engages and energizes people |

RECENT BOARD ACTIONS

| ■ | Board Refreshment: Our approach to Board refreshment and diversity continues to be informed by our shareholders’ perspectives. Recent additions to our Board further enhanced our Board’s skill sets and diversity. We completed a transition of the independent Chair role at the 2020 Annual Meeting. |

| ■ | Compensation: The total annual compensation of non-employee directors elected at the Company’s 2020 annual meeting in May 2020 was reduced by 20% effective from the annual meeting on May 15, 2020 through December 31, 2020, and then reinstated on a pro-rated basis for the remainder of their term effective January 1, 2021. The annual salary of the CEO was reduced by 20% effective from April 1, 2020 through December 31, 2020 and then reinstated effective January 1, 2021. The annual salary rates of the other Executive Officers were reduced by 20% effective from April 1, 2020 through September 30, 2020 and then reinstated effective October 1, 2020. |

| ■ | Sustainability: We continue to evolve and enhance our sustainability practices and disclosure, taking into account multiple years of shareholder feedback. Our 2019 Sustainability Report included metrics reported in accordance with SASB, and our 2020 supplemental report included three-year progress on environmental metrics and introduced baseline metrics around workplace diversity. |

We encourage shareholders to continue to engage with us and let us know their thoughts about ITT or to bring any matters to our shareholders andattention. Please feel free to seek input in orderwrite directly to provide perspective on Company policies and practices. We gain valuable feedback from this type of engagement and the feedback is shared with the Board and its relevant committees. One recent example is our adoption of a proxy access bylaw last year, which the Board adopted after hearing the feedback from months of thoughtful discussions with various shareholders.

ITT INC. | 2021 PROXY STATEMENT.17 Communications

BOARD AND COMMITTEE MEETINGS AND MEMBERSHIP

The Board and its committees meet throughout the year on a set schedule, and also hold special meetings and act by written consent from time to time as appropriate. Under the Principles, directors are distributedexpected to attend all meetings of the Board and all meetings of the committees of which they are members. Members may attend by telephone or video conference, although in-person attendance at regularly scheduled meetings is strongly encouraged. Since March 2020, all Board and committee meetings have been held telephonically or through video conference due to the COVID-19 pandemic. The Board held 11 meetings during the 2020 fiscal year, and there were 22 meetings of standing committees. All directors attended at least 75% of the aggregate of all meetings of the Board and standing committees on which they served. It is Company practice that all directors attend our annual meetings. All directors who were on the Board at that time attended our 2020 annual meeting of shareholders either in person or to any individual director or directors, as appropriate under the facts and circumstances. Junk mail, advertisements, product inquiries or complaints, resumes, spam and surveys are not forwarded to the Board. Material that is threatening, unduly hostile or similarly inappropriate will also not be forwarded, although any non-management director may request that any communications that have been excluded be made available.

The Board has adoptedan Audit Committee, a written Related Party Transaction Policy (the "Policy")Compensation and Human Capital Committee, and a Nominating and Governance Committee. The following table summarizes the current membership of each Committee:

| Compensation | |||

| and Human | Nominating and | ||

| Name | Audit | Capital | Governance |

| Orlando D. Ashford |  |  | |

| Geraud Darnis |  |  | |

| Donald DeFosset, Jr. |  |  | |

| Nicholas C. Fanandakis |  |  | |

| Richard P. Lavin | |||

| Mario Longhi |  |  | |

| Rebecca A. McDonald |  |  | |

| Timothy H. Powers |  |  | |

| Luca Savi | |||

| Cheryl L. Shavers |  |  | |

| Sabrina Soussan |  |  | |

Chair Chair |

ITT INC. | 2021 PROXY STATEMENT18

BOARD AND COMMITTEE ROLES IN OVERSIGHT OF RISK

ITT INC. | 2021 PROXY STATEMENT19

The charters of each of the Audit, Compensation and Human Capital and Nominating and Governance Committees conform with the applicable NYSE listing standards, and each committee reviews its charter at least annually, and as regulatory developments and business circumstances warrant. Each of the committees considers revisions to its respective charter from time to time to reflect evolving best practices. The descriptions below of the roles and responsibilities of each of the committees of the Board are qualified by reference to the complete committee charters, which are available on our website at www.itt.com/investors/corporate-governance.

AUDIT COMMITTEE

| Attendance | Responsibilities |

| Meetings Held in 2020: 8 Committee Members Timothy H. Powers (Chair) Geraud Darnis Donald DeFosset, Jr. Nicholas C. Fanandakis Mario Longhi Sabrina Soussan | Purpose: assist the Board of Directors in fulfilling its responsibility to oversee management’s conduct of the financial reporting process. The Audit Committee is primarily responsible for: ■reviewing and discussing with management and the independent auditor the annual audited and quarterly unaudited financial statements and approving those financial statements for inclusion in the Company’s public filings; ■reviewing and overseeing the Company’s selection and application of accounting principles and matters relating to the Company’s internal controls and disclosure controls and procedures; ■overseeing the Company’s compliance with legal and regulatory requirements, including reviewing the effect of regulatory and accounting initiatives on the Company’s financial statements; ■overseeing the structure and scope of the Company’s internal audit function; and ■overseeing the Company’s policies on risk assessment and management. The Audit Committee is also directly responsible for the selection and oversight of the Company’s independent registered public accounting firm, including determining the firm’s qualifications, independence, scope of responsibility and compensation. |

| Audit Committee Report, Page 35 | |

The Audit Committee has established policies and procedures for the pre-approval of all services by our independent registered public accounting firm. The Audit Committee also has established procedures for the receipt, retention and treatment, on a confidential basis, of complaints received regarding accounting, internal controls and auditing matters. Additional details on the role of the Audit Committee may be found in “Ratification of the Independent Registered Public Accounting Firm (Proxy Item No. 2)” later in this Proxy Statement.

The Board of Directors has determined that addresseseach member of the reporting, reviewAudit Committee is financially literate and approval or ratificationindependent, as defined by the rules of transactionsthe SEC and the NYSE’s listing standard, as well as independent under the Principles. Although more than one member of the Audit Committee satisfies the relevant requirements, the Board of Directors has identified Timothy H. Powers as the Audit Committee financial expert. The Board of Directors has evaluated the performance of the Audit Committee consistent with related parties. regulatory requirements.

ITT INC. | 2021 PROXY STATEMENT20

COMPENSATION AND HUMAN CAPITAL COMMITTEE

| Attendance | Responsibilities |

| Meetings Held in 2020: 8 Committee Members Orlando Ashford (Chair) Geraud Darnis Nicholas Fanandakis Mario Longhi Rebecca A. McDonald Cheryl L. Shavers | Purpose: provide oversight of the compensation and benefits provided to employees of the Company. The Compensation and Human Capital Committee evaluates and approves the compensation plans, policies and programs for the Chief Executive Officer and the other executive officers of ITT Inc., and approves awards under the Company’s equity incentive plans. Its responsibilities also include: ■ setting annual performance goals and objectives with respect to the Chief Executive Officer; ■ approving annual performance objectives, reviewing performance and approving individual compensation actions for the other executive officers; ■ reviewing and discussing the Company’s talent review and development process, succession planning process for executive officers (including the CEO) and other critical senior management roles; ■ providing oversight of the Company’s human capital management programs, including diversity, equity and inclusion programs and management development; and ■ approving the Compensation Discussion and Analysis included in the Company’s annual proxy statement. |

| Compensation and Human Capital Committee Report, Page 68 | |

The Policy covers (butname of the committee was changed from the Compensation and Personnel Committee in 2020. The Board of Directors has determined that each member of the Compensation and Human Capital Committee is not limited to) those related party transactionsindependent, as defined by the rules of the SEC and relationships required to be disclosedthe NYSE’s listing standard, as well as independent under Item 404(a)the Principles and Section 2.10 of the Company’s By-laws. In addition, each committee member is a “non-employee director” as defined in Rule 16b-3 under the Securities Exchange Commission's (the "SEC"Act of 1934 (“Exchange Act”) Regulation S-K, and applies to each director or executive officer. The Board of Directors has evaluated the performance of the Company; any nominee for election as aCompensation and Human Capital Committee consistent with regulatory requirements.

NOMINATING AND GOVERNANCE COMMITTEE

| Attendance | Responsibilities |

| Meetings Held in 2020: 6 Committee Members Donald DeFosset, Jr. (Chair) Orlando D. Ashford Rebecca A. McDonald Timothy H. Powers Cheryl L. Shavers Sabrina Soussan | Purpose: ensure that the Board of Directors is appropriately constituted to meet its fiduciary obligations to shareholders of the Company. The Nominating and Governance Committee oversees the practices, policies and procedures of the Board and its committees. Responsibilities include: ■ evaluating the size, composition, governance and structure of the Board and the qualifications, compensation and retirement age of directors; ■ identifying, evaluating and proposing nominees for election to the Board; ■ considering the independence and possible conflicts of interest of directors and executive officers and ensuring compliance with applicable laws and NYSE listing standards; and ■ overseeing the Company’s overall enterprise risk management program. The Nominating and Governance Committee is charged with: ■ overseeing the self-evaluations of the Board and its committees; ■ reviewing the Principles; ■ reviewing material related party transactions in accordance with our Related Party Transactions Policy; ■ monitoring our directors’ outside engagements and administering our director resignation procedures when there is a change in a director’s employment status; and ■ evaluating the compensation program for the non-management directors. The Committee also maintains an informed status on the Company’s sustainability initiatives and on activities involving community relations and philanthropy. |

ITT INC. | 2021 PROXY STATEMENT21

The Board of the Company; any security holder who is known to the Company to own of record or beneficially more than 5% of any class of the Company's voting securities; and any immediate familyDirectors has determined that each member of any of the foregoing persons (each, a "Related Party").

As stated above, the Nominating and Governance Committee evaluates the compensation program for the non-management directors and makes recommendations to the Board regarding their compensation. The Nominating and Governance Committee has determined doretained Pay Governance LLC (“Pay Governance”) as an independent consultant for this purpose. Pay Governance’s responsibilities include providing market comparison data on non-management director compensation at peer companies, tracking trends in non-management director compensation practices, and advising the Nominating and Governance Committee regarding the components and levels of non-management director compensation. The Nominating and Governance Committee is not pose a significant riskaware of any conflict of interest on the part of Pay Governance arising from these services or any other factor that would impair Pay Governance’s independence. Executive officers do not play any role in either because a Related Party would not have a material interest in a transactiondetermining or recommending non-management director compensation.

EXECUTIVE SESSIONS OF DIRECTORS

Agendas for meetings of that type or due to the nature, size and/or degreeBoard of significance toDirectors include regularly scheduled executive sessions led by the Company. The Policy is re-evaluated periodically.

Our directors and othercertain employees (including executive officers. In addition, the Company will disclose within four business days any substantive changesofficers) are prohibited from hedging and speculative trading in or waiversand out of the Code of Conduct granted toCompany’s securities, including short sales and leverage transactions, such as puts, calls, and listed and unlisted options.

We also prohibit our Chief Executive Officer, Chief Financial Officerdirectors and Principal Accounting Officer, or persons performing similar functions. We will do this by posting such information on our websitecertain employees from pledging Company securities as set forth above rather than by filingcollateral for a Form 8-K.

The Board of Directors, through the Nominating and Governance Committee, conducts an annual review of the independence of its members. With the assistance of legal counsel to the Company, the Nominating and Governance Committee has reviewed the applicable standards for Board and committee member independence, as well as the standards established by the Principles. A summary of the answers to annual questionnaires completed by each of the directors and a report of transactions with director-affiliated entities are also made available to the Nominating and Governance Committee to enable its comprehensive independence review. On the basis of this review, the Nominating and Governance Committee has delivered a report to the full Board of Directors, and the Board has made its independence determinations based upon the committee'scommittee’s report and the supporting information.

Under NYSE listing standards, an independent director must not have any material relationship with the Company, either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company. The NYSE requirements pertaining to director independence also include a series of objective tests, such as the requirement that the director is not an employee of the Company and has not engaged in various types of business dealings with the Company. The Board also considers whether directors have any relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The SEC has a separate independence requirement for audit committeeAudit Committee members that overlays the NYSE requirements. The NYSE also recently promulgated rules requiringrequires directors that serve on compensation committees to satisfy additional independence requirements specific to that service.

The Board of Directors has determined that Ms. RamosMr. Savi is not "independent"“independent” because of herhis employment as Chief Executive Officer and President of the Company. The Board of Directors has reviewed all relationships between the Company and each other member of the Board of Directors and has affirmatively determined that all of the members of the Board other than Ms. RamosMr. Savi are "independent"“independent” pursuant to the applicable listing standards of the NYSE. None of these directors were disqualified from "independent"“independent” status under the objective tests set forth in the NYSE standards. In assessing independence under the

ITT INC. | 2021 PROXY STATEMENT22

subjective relationships test described above, the Board of Directors took into account the criteria for disqualification set forth in the NYSE'sNYSE’s objective tests, and reviewed and discussed additional information provided by each director and the Company with regard to each director'sdirector’s business and personal activities as they may relate to the Company and its management. Based on the foregoing, as required by the NYSE, the Board made the subjective determination as to each of these directors that no material relationships with the Company exist and no relationships exist which, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of such director. The Board also determined that the current members of the Audit Committee and of the Compensation and PersonnelHuman Capital Committee meet the applicable SEC and NYSE listing standard independence requirements with respect to membership on such committees.

In making its independence determinations, the Board considered transactions occurring since the beginning of the Company's 2014Company’s 2018 fiscal year between the Company and entities associated with the directors or members of their immediate family. All identified transactions that appear to relate to the Company and a person or entity with a known connection to a director were presented to the Board of Directors for consideration. The Board also considered in its analysis the Company'sCompany’s contributions to tax-exempt organizations with respect to each of the non-management directors. In making its subjective determination that each non-management director is independent, the Board considered the transactions in the context of the NYSE objective standards, theand special standards established by the SEC for members of audit committees, and the SEC and Internal Revenue Service (the "IRS") standards for compensation committee members.committees. In each case, the Board determined that, because of the nature of the director'sdirector’s relationship with the entity and/or the amount involved in the transaction, the relationship did not impair the director'sdirector’s independence. The Company did not make any contributions to any tax exempt organizations in which any non-management director serves as an executive officer within the past three fiscal years where such contributions exceeded the greater of $1 million or 2% of such organization'sorganization’s consolidated gross revenues.

The Company has also adopted the ITT Code of Conduct which applies to all employees, including the Chief Executive Officer, Chief Financial Officer and Committee RolesPrincipal Accounting Officer and, where applicable, to its non-management directors. The ITT Code of Conduct is available on our website at https://www.itt. com/newsroom/publications/code-of-conduct. We disclose on our website any changes or waivers from the Code of Conduct for the Company’s Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, our non-management directors and other executive officers. In addition, the Company will disclose within four business days any substantive changes in Oversight of Risk

The Company has established a cross-functional teamconfidential ethics phone line and website to respond to employees’ questions and reports of members of management referred to as the Risk Center of Excellence ("RCOE"), to internally monitor various risks. Each committee of the Board receives regular reports from the RCOE within the relevant expertise of that committee. For example, the Compensation and Personnel Committee reviews and assesses compensation and incentive program risks to ensure that the Company's compensation programs encourage innovation and balance appropriate business risks and rewards without encouraging risk-taking behaviors that may have a material adverse effect on the Company, and it receives an annual report from the RCOE evaluating these risks. In addition to its duties in assessing major financial risk exposures,ethical concerns. Also, the Audit Committee also provides oversighthas established a policy with procedures to receive, retain and treat complaints received by the Company regarding accounting, internal controls or auditing matters, and to allow for the confidential, anonymous submission by employees of the Company's policies with respect to risk assessment and risk management.

None of the members of the Compensation and PersonnelHuman Capital Committee during 20162020 or as of the date of this Proxy Statement havehas been an officer or employee of the Company and no executive officer of the Company served on the compensation committee or board of any company that employed any member of our Compensation and PersonnelHuman Capital Committee or Board of Directors.

ITT INC. | 2021 PROXY STATEMENT23

Shareholders and Composition

POLICIES FOR APPROVING RELATED PARTY TRANSACTIONS

The Board has adopted a written Related Party Transaction Policy (the “Policy”) that addresses the reporting, review and approval or ratification of Directors qualified candidatestransactions with related parties. The Policy covers (but is not limited to) those related party transactions and relationships required to be disclosed under Item 404(a) of the SEC’s Regulation S-K, and applies to each director or executive officer of the Company, any nominee for membershipelection as a director of the Company, any security holder who is known to the Company to own of record or beneficially more than 5% of any class of the Company’s voting securities, and any immediate family member of any of the foregoing persons (each, a “Related Party”).

The Company recognizes that transactions with Related Parties may involve potential or actual conflicts of interest and pose the risk that they may be, or be perceived to have been, based on considerations other than the Board,Company’s best interests. Accordingly, as a general matter, the Company seeks to avoid such transactions. However, the Company recognizes that in some circumstances transactions between Related Parties and the Company may be incidental to the normal course of business, may provide an opportunity that is in the best interests of the Company to pursue, or may not otherwise be inconsistent with the best interests of the Company. In other cases it may be inefficient for the Company to pursue an alternative transaction. The Policy therefore is not designed to prohibit Related Party transactions; rather, it is designed to provide for timely internal reporting of such transactions and appropriate review, oversight and public disclosure of them. The Policy supplements the provisions of our Code of Conduct concerning potential conflict of interest situations. Under the Policy, an amendment to an arrangement that is considered a Related Party transaction is, unless clearly incidental in nature, considered a separate Related Party transaction.

The Policy provides for the Nominating and Governance Committee takes into accountto review all Related Party transactions and, wherever possible, to approve such transactions in advance of any such transaction being given effect. In connection with approving or ratifying a variety of factors. Directors of the Company must be persons of integrity, with significant accomplishments and recognized business stature. In addition, the Principles state that as part of the membership criteria for new Board members, individuals must possess such attributes and experiences as are necessary to provide a broad range of personal characteristics including diversity, management skills and business, technological and international experience, among others. The Nominating and Governance Committee's top priority is therefore ensuring that the Board is composed of directors who bring diverse viewpoints and perspectives, exhibit a variety of skills, professional experience and backgrounds, and effectively represent the long-term interests of shareholders. The Board actively seeks to consider diverse candidates for membership on the Board when it has a vacancy to fill and includes diversity as a specific factor when conducting any search for candidates.

| ■ | the position within or relationship of the Related Party with the Company; |

| ■ | the materiality of the transaction to the Related Party and the Company, including the dollar value of the transaction, without regard to profit or loss; |

| ■ | the business purpose for and reasonableness of the transaction, taken in the context of the alternatives available to the Company for attaining the purposes of the transaction; |

| ■ | whether the transaction is comparable to a transaction that could be available on an arms-length basis or is on terms that the Company offers generally to persons who are not Related Parties; |

| ■ | whether the transaction is in the ordinary course of our business and was proposed and considered in the ordinary course of business; and |

| ■ | the effect of the transaction on our business and operations, including on the Company’s internal control over financial reporting and system of disclosure controls or procedures, and any additional conditions or controls (including reporting and review requirements) that should be applied to such transaction. |

The Policy provides standing pre-approval for certain types of transactions that longer-tenured directors bring, as well as significant benefits from the fresh perspective and ideas brought by new directors. Since the beginning of 2013, we have added five new independent directors who have brought valuable and varied experience to our Board.

ITT INC. | 2021 PROXY STATEMENT24

| Back to Contents | |

|

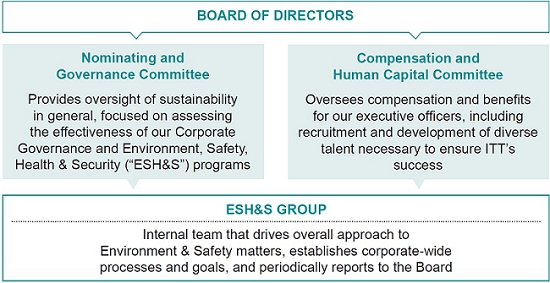

CORPORATE RESPONSIBILITY AND SUSTAINABILITY

At ITT, we know that improving our sustainability efforts creates value for our customers, employees, communities and shareholders. It helps us align to the values and emerging expectations of today’s world.

The Board also understands that sustainability is a key focus for investors and takes investor feedback on sustainability seriously. We continue to evaluate which ESG factors pose the most material risks to the Company and create the strongest opportunities to enhance our bottom line and sustain long-term financial value.

ITT uses discussions with shareholders to better understand how investors view this topic, including emerging reporting standards, the various data sources available, and peer reporting.

We also use these shareholder engagement opportunities to discuss the Company’s current sustainability focus areas and recent developments. Our 2019 Sustainability Report was informed by those discussions with investors. The Sustainability Report incorporated the SASB metrics relevant to the Company, as requested by many of our shareholders in our engagement discussions. We also published an annual supplemental report during 2020 which included our three-year progress on key environmental and social metrics.

Our governance processes and policies are designed to provide appropriate oversight of sustainability and inform our Board about significant ESG issues impacting the Company. These policies and processes, as well as areas of focus most relevant given our business and industry, are informed by proactive engagement with our shareholders as well as other stakeholders, including the SASB.

The Nominating and Governance Committee identifies director candidates through a variety of sources including personal references and business contacts. On occasion, the Nominating and Governance Committee utilizes a search firm to identify and screen director candidates and pays a fee to that firm for each such candidate elected to the ITT Board. The Nominating and Governance Committee will also consider director nominees recommended by shareholders. Shareholders who wish to recommend candidates may contact the Nominating and Governance Committee in the manner described in "

ITT INC. | 2021 PROXY STATEMENT25

| Back to Contents | |

Each director must be elected by a majority of the votes cast by the shareholders represented in personat the virtual meeting or by proxy at the Annual Meeting. A "majority“majority of the votes cast"cast” means that the number of votes cast "for"“for” a director must exceed the number of votes cast "against"“against” that director (with abstentions and broker non-votes not counted as votes cast with respect to that director). In a contested election for directordirectors (an election in which the number of nominees for election as directordirectors is greater than the number of directors to be elected), the vote standard would be a plurality of votes cast.

In accordance with our By-laws and Corporate Governancethe Principles, the Board will only nominate director candidates who agree to tender an irrevocable resignation promptly following their failure to receive the required vote for re-election in an uncontested election. In addition, the Board will fill director vacancies and new directorships only with candidates who agree to tender the same form of resignation promptly following their appointment to the Board.

If an incumbent director fails to receive the required vote for re-election in an uncontested election and submits his or her resignation to the ChairmanChair of the Board or the Corporate Secretary, then the Nominating and Governance Committee (or the equivalent committee then in existence) shall promptly consider the resignation and all relevant facts and circumstances concerning any vote and the best interests of the Company and its shareholders. After such consideration, the Nominating and Governance Committee will make a recommendation to the Board regarding whether the resignation should be accepted or rejected, or whether any other action should be taken. The Board will act on the Committee'sCommittee’s recommendation no later than its next regularly scheduled Board meeting (after certification of the shareholder vote) or within 90 days after certification of the shareholder vote, whichever is earlier, and the Board will promptly publicly disclose its decision and the reasons for its decision.

Each nominee elected as a director will continue in office until the earlier of the 2018 annual meeting2022 Annual Meeting of shareholders,Shareholders, his or her successor having been duly elected and qualified, or his or her death, resignation or removal.

The 1011 nominees for election to the Board in 20172021 have agreed to serve if elected, and management has no reason to believe that such nominees will be unavailable to serve. In the event that any of the nominees is unable or declines to serve as a director at the time of the Annual Meeting, then the persons named as proxies may vote for a substitute nominee chosen by the present Board to fill the vacancy. Alternatively, the Board may reduce the size of the Board of Directors. The individuals named as proxies in the proxy card intend to vote theyour proxy (if you are a shareholder of record) FOR the election of each of these nominees, unless you indicate otherwise on the proxy card.

Eleven members of our currentBoard are standing for election to hold office until the 2022 Annual Meeting of Shareholders.

We believe our 2021 director nominees evidence our commitment to maintain an appropriate balance of tenure, turnover, diversity and skills on the Board. Of the 11 directors Mr. D'Aloia, will retirewho are nominees for election at the Annual Meeting, three are female, three are racially or ethnically diverse, and four are citizens of a non-U.S. country (in some cases, in addition to the U.S.). As discussed in detail in our nominees’ biographies, the nominees come from diverse professional backgrounds and industries, including manufacturing, finance and technology. Each of our 2021 director nominees was recommended for election by the Company's Board effective May 10, 2017, which isNominating and Governance Committee, and such recommendation was approved unanimously by the end of his term, in accordance with the requirement in the Corporate Governance Principles that no director shall stand for reelection after he or she has reached the age of 72.Board.

ITT INC. | 2021 PROXY STATEMENT 26

The principal occupation and certain other biographical information about the nominees is set forth on the following pages.

| ORLANDO D. ASHFORD | ||

Age: 52 Director since: December 2011 ExecutiveChairman ofAzamara | ||

| CAREER: Orlando D. Ashford | Perrigo Company plc.

In considering Mr. Ashford for director of the Company, the Board considered his expertise in addressing talent, culture and human capital issues at the executive level, as well as his significant experience in multinational organizations, providing experience and skills relevant to the BOARD COMMITTEES: ■ Compensation and Human Capital Committee (Chair) ■ Nominating and Governance Committee OTHER PUBLIC COMPANY BOARDS: ■ Array Technologies, Inc. ■ Perrigo Company plc |

| GERAUD DARNIS | ||

Age: 61 Director October 2015 Former | ||

| CEO of UTCBuilding &IndustrialSystems |

Geraud Darnis

In considering Mr. Darnis for director of the Company, the Board considered his significant management experience as president of a major operating unit at a large global manufacturing company and his wide-ranging expertise in a variety of industries in which the Company operates, including industrial and aerospace. | |

■ Compensation and Human Capital Committee | |||

ITT INC. | 2021 PROXY STATEMENT 27

| DONALD DEFOSSET, JR. | ||

Age: 72 Director since: October 2011 FormerChairman,President &CEO of WalterIndustries, Inc. | ||